All Categories

Featured

Table of Contents

While lots of life insurance policy products need a medical examination, final cost insurance coverage does not. When requesting last expenditure insurance coverage, all you have to do is address several concerns about your wellness. 2 With final expense insurance policy, premiums are locked in as soon as you obtain authorized. 3 They'll never increase as long as your plan continues to be active.

This indicates that a particular amount of time must pass before benefits are paid. If you're older and not in the very best health, you may observe greater premiums for final expenditure insurance policy. You may be able to discover more economical protection with one more kind of plan. Prior to you devote to a last expense insurance coverage, consider these factors: Are you merely seeking to cover your funeral and interment expenses? Do you wish to leave your loved ones with some money to spend for end-of-life prices? If so, last cost insurance is likely a good fit.

If you 'd like enough protection without breaking the financial institution, last cost insurance policy may be worthwhile. In this instance, it may be wise to take into consideration last cost insurance.

Burial Insurance Cost For Seniors

Protection amount picked will certainly be the same for all protected children and may not surpass the face amount of the base policy. Concern ages start at 30 days via less than 18 years old. Plan comes to be exchangeable to a whole life plan between the ages of 22 to 25. A handful of elements affect just how much final expense life insurance policy you genuinely require.

They can be used on anything and are developed to aid the beneficiaries stay clear of a financial situation when a liked one passes. Funds are commonly utilized to cover funeral costs, medical costs, settling a home loan, vehicle loans, and even made use of as a savings for a brand-new home. If you have enough cost savings to cover your end-of-life expenditures, after that you may not need last expense insurance coverage.

Furthermore, if you have actually been not able to get approved for larger life insurance policy policies as a result of age or clinical conditions, a final cost plan may be a budget friendly option that lowers the problem positioned on your household when you pass. Yes. Final expense life insurance policy is not the only method to cover your end-of-life costs.

These normally offer higher coverage quantities and can protect your family's way of life as well as cover your last costs. Associated: Whole life insurance policy for senior citizens.

They are commonly provided to candidates with several health and wellness problems or if the applicant is taking certain prescriptions. If the insured passes during this period, the beneficiary will generally get all of the costs paid into the plan plus a little added portion. One more final cost alternative used by some life insurance policy companies are 10-year or 20-year plans that give candidates the alternative of paying their plan completely within a certain timespan.

Silver Care Life Final Expense Plan

One of the most crucial point you can do is address concerns truthfully when getting end-of-life insurance policy. Anything you withhold or conceal can cause your advantage to be refuted when your family members needs it most. Some people believe that due to the fact that many final cost plans do not call for a medical examination they can exist concerning their wellness and the insurer will never ever understand.

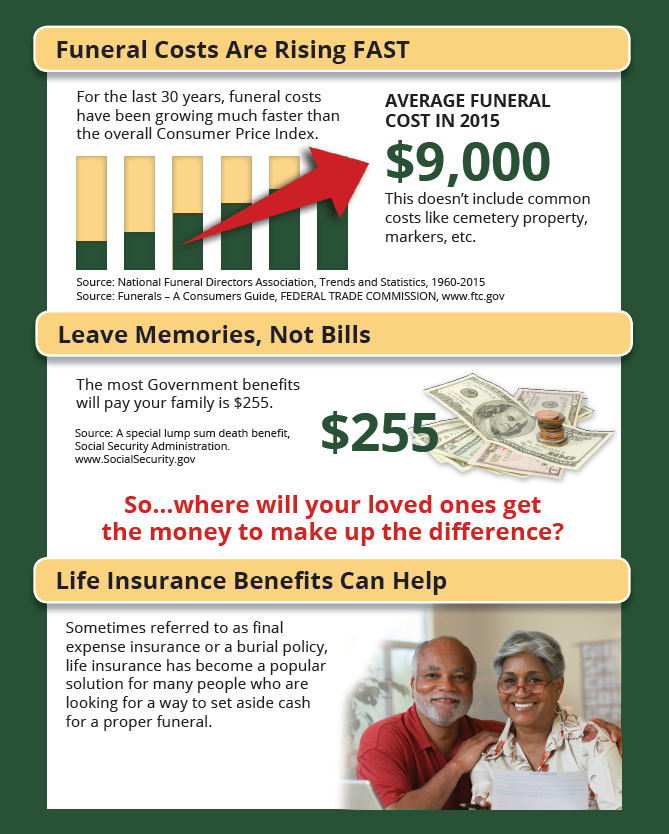

Share your final desires with them as well (what flowers you could want, what passages you want reviewed, songs you want played, etc). Documenting these beforehand will certainly conserve your liked ones a lot of stress and anxiety and will certainly avoid them from attempting to think what you desired. Funeral costs are rising all the time and your health and wellness can transform suddenly as you grow older.

It is very important to examine your coverage frequently to guarantee you have sufficient to shield making it through relative. The primary recipient obtains 100% of the survivor benefit when the insured dies. If the main recipient passes prior to the insured, the contingent receives the benefit. Tertiary recipients are typically a last option and are just used when the main and contingent recipients pass before the insured.

Constantly inform your life insurance firm of any type of modification of address or phone number so they can update their documents. Lots of states enable you to pre-pay for your funeral.

The fatality advantage is paid to the primary beneficiary once the case is authorized. It relies on the insurer. The majority of people can get coverage up until they transform 85. There are some business that insure a person over the age of 85, but be prepared to pay an extremely high premium.

Life And Burial Insurance

If you do any kind of type of funeral planning beforehand, you can document your last dreams for your key recipient and demonstrate how much of the policy advantage you wish to go towards last setups. The procedure is usually the very same at every age. A lot of insurance policy firms call for a specific be at the very least one month old to make an application for life insurance coverage.

Some business can take weeks or months to pay the plan benefit. Others, like Lincoln Heritage, pay accepted cases in 24 hours. It's difficult to say what the average costs will be. Your insurance rate depends upon your health and wellness, age, sex, and how much coverage you're taking out. A good quote is anywhere from $40-$60 a month for a $5,000 $10,000 plan.

Cigarette prices are higher no issue what sort of life insurance coverage you get. The older you are, the higher your tobacco price will be. Final expenditure insurance policy raises a financial burden from households grieving the loss of a person they enjoy. If you wish to give those you appreciate a safeguard throughout their time of grief, this policy type is a fantastic choice.

Last expenditure insurance has a death advantage designed to cover expenses such as a funeral service or funeral, embalming and a casket, or cremation. Nevertheless, beneficiaries can utilize the death benefit for any kind of objective, from paying real estate tax to taking a getaway. "They market the final expense insurance to people that are older and beginning to believe concerning their funeral costs, and they make it appear like they need to do it in order to look after their family members," says Sabo.

Last expenditure insurance policy is a small whole life insurance policy that is simple to get. The recipients of a last expenditure life insurance policy plan can utilize the policy's payout to pay for a funeral service, coffin or cremation, clinical costs, taking care of home costs, an obituary, flowers, and a lot more. Nevertheless, the death benefit can be made use of for any type of purpose whatsoever.

When you obtain final expenditure insurance, you will certainly not have to take care of a medical examination or let the insurer accessibility your medical records. Nonetheless, you will need to address some health inquiries. Due to the wellness questions, not everybody will certify for a policy with protection that starts on the first day.

New Funeral Expense Benefit

The older and less healthy you are, the higher your rates will be for a given amount of insurance policy. Male often tend to pay higher rates than females due to their much shorter average life span. And, relying on the insurer, you may get approved for a reduced price if you do not use cigarette.

Depending on the policy and the insurance company, there might be a minimum age (such as 45) and optimum age (such as 85) at which you can apply. The biggest survivor benefit you can choose may be smaller sized the older you are. Plans might rise to $50,000 as long as you're younger than 55 but just increase to $25,000 once you transform 76.

Let's claim you're retired, no longer have life insurance coverage with your company, and don't have an individual life insurance coverage plan. You're considering a brand-new life insurance policy.

Latest Posts

Term Life Insurance Instant

Whole Life Insurance Quotes Online Instant

Instant Term Life Insurance Quotes Online