All Categories

Featured

Table of Contents

Finest Firm as A++ (Superior; Top classification of 15). The score is since Aril 1, 2020 and undergoes transform. MassMutual has received various scores from various other score agencies. Sanctuary Life And Also (And Also) is the advertising name for the Plus biker, which is included as part of the Haven Term policy and uses access to extra services and benefits at no charge or at a discount rate.

Figure out more in this guide. If you depend on somebody financially, you might wonder if they have a life insurance policy policy. Learn how to discover out.newsletter-msg-success,. newsletter-msg-error screen: none;.

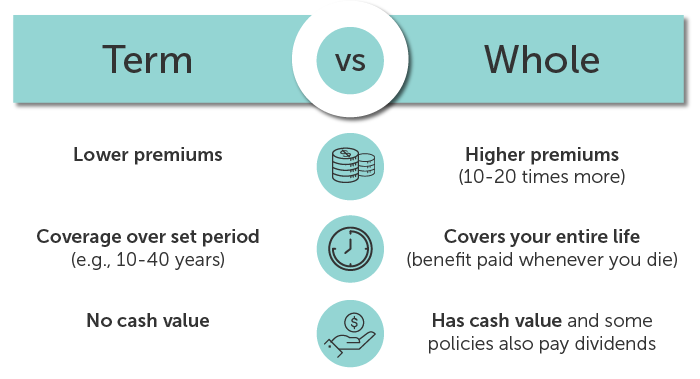

There are multiple kinds of term life insurance policy plans. As opposed to covering you for your whole life-span like whole life or global life policies, term life insurance policy just covers you for an assigned amount of time. Plan terms typically vary from 10 to three decades, although shorter and longer terms may be offered.

Many generally, the plan ends. If you wish to maintain protection, a life insurance firm might supply you the option to restore the plan for another term. Or, your insurer may permit you to transform your term plan to a long-term policy. If you included a return of costs motorcyclist to your plan, you would receive some or every one of the cash you paid in premiums if you have outlasted your term.

What should I know before getting Term Life Insurance With Fixed Premiums?

Degree term life insurance policy may be the ideal alternative for those that want coverage for a set amount of time and want their costs to remain secure over the term. This may apply to consumers worried concerning the cost of life insurance policy and those who do not wish to transform their survivor benefit.

That is since term policies are not guaranteed to pay, while long-term policies are, offered all premiums are paid. Degree term life insurance policy is typically a lot more pricey than lowering term life insurance policy, where the fatality advantage lowers with time. Besides the kind of plan you have, there are numerous other variables that help identify the price of life insurance policy: Older applicants normally have a greater death danger, so they are usually more expensive to guarantee.

On the other hand, you may be able to secure a cheaper life insurance policy rate if you open up the plan when you're younger - Tax benefits of level term life insurance. Comparable to innovative age, bad wellness can also make you a riskier (and much more costly) prospect forever insurance. If the problem is well-managed, you may still be able to find economical coverage.

Nonetheless, health and age are typically a lot more impactful premium factors than gender. High-risk pastimes, like scuba diving and skydiving, might lead you to pay even more for life insurance policy. Likewise, risky tasks, like window cleaning or tree cutting, might also increase your cost of life insurance policy. The ideal life insurance coverage firm and policy will depend upon the person looking, their personal ranking aspects and what they require from their policy.

How does 30-year Level Term Life Insurance work?

The primary step is to determine what you require the policy for and what your budget is (Compare level term life insurance). When you have a good idea of what you want, you may wish to contrast quotes and plan offerings from numerous business. Some firms use online pricing quote for life insurance coverage, but numerous require you to call a representative over the phone or in person.

One of the most prominent kind is now 20-year term. Most firms will not offer term insurance policy to an applicant for a term that finishes previous his/her 80th birthday. If a plan is "sustainable," that means it proceeds effective for an additional term or terms, approximately a defined age, even if the health and wellness of the insured (or other aspects) would certainly trigger him or her to be declined if he or she applied for a brand-new life insurance coverage plan.

So, costs for 5-year sustainable term can be degree for 5 years, then to a new price showing the new age of the guaranteed, and more every 5 years. Some longer term plans will certainly ensure that the costs will certainly not raise during the term; others don't make that warranty, allowing the insurer to increase the rate throughout the policy's term.

This suggests that the plan's proprietor deserves to transform it right into a long-term kind of life insurance policy without extra evidence of insurability. In many kinds of term insurance, including property owners and auto insurance coverage, if you have not had a case under the policy by the time it ends, you get no reimbursement of the costs.

How much does Term Life Insurance With Fixed Premiums cost?

Some term life insurance policy consumers have actually been miserable at this outcome, so some insurance providers have produced term life with a "return of costs" attribute. The premiums for the insurance with this attribute are typically substantially greater than for plans without it, and they generally call for that you maintain the plan active to its term otherwise you surrender the return of premium advantage.

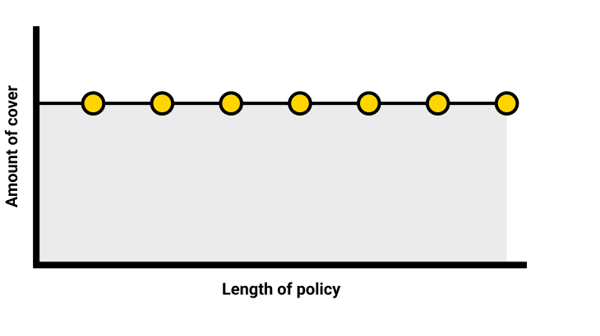

Level term life insurance costs and fatality advantages remain regular throughout the policy term. Level term life insurance coverage is commonly a lot more cost effective as it does not build cash worth.

While the names typically are made use of interchangeably, level term insurance coverage has some essential distinctions: the premium and survivor benefit remain the exact same throughout of protection. Degree term is a life insurance policy where the life insurance premium and survivor benefit continue to be the same throughout of coverage.

These policies can last for a 10-year term, 15-year term, 20-year term or 30-year term. The length of your protection period may depend upon your age, where you are in your job and if you have any type of dependents. Like other kinds of life insurance protection, a level term policy supplies your beneficiaries with a fatality advantage that's paid if you pass away throughout your protection duration.

How can Level Term Life Insurance Policy Options protect my family?

That generally makes them a more economical alternative permanently insurance protection. Some term plans may not maintain the costs and fatality profit the very same gradually. You do not intend to incorrectly assume you're buying degree term coverage and after that have your survivor benefit change later. Lots of people get life insurance protection to help economically shield their loved ones in situation of their unanticipated death.

Or you may have the choice to transform your existing term protection right into an irreversible policy that lasts the remainder of your life. Different life insurance policy policies have potential benefits and drawbacks, so it is very important to comprehend each prior to you choose to purchase a plan. There are a number of benefits of term life insurance policy, making it a preferred selection for coverage.

Latest Posts

Term Life Insurance Instant

Whole Life Insurance Quotes Online Instant

Instant Term Life Insurance Quotes Online